Analysis on Related Party Transaction Under Section 188 of the Companies Act, 2013 – Section 188 of Companies Act, 2013 is been made effective from 01.04.2014 and since than the same been amended nine times till date. In this article Analyses Provision of Section 188-

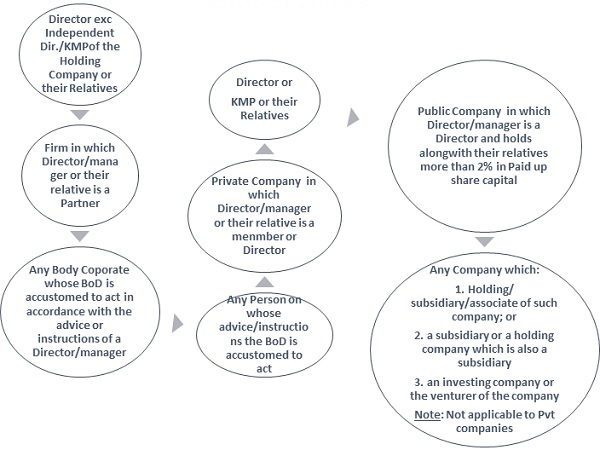

Meaning of Related Party

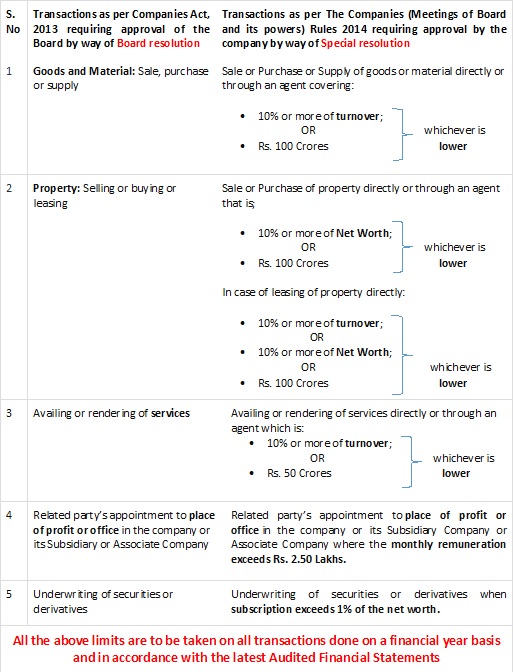

Transactions Covered

Some Important Definitions:

1. Goods means every kind of movable property other than actionable claim and money and includes stock and shares, growing crops, grass attached to or forming part of the land which are agreed to be severed before sale or under contract of sale.

2. “office or place of profit” means any office or place—

(i) if the director receives from the company anything by way of remuneration over and above the remuneration to which he is entitled as director, by way of salary, fee, commission, perquisites, any rent-free accommodation, or otherwise;

(ii) if any individual other than a director or any firm, private company or other body corporate, if the individual, firm, private company or body corporate holding receives from the company anything by way of remuneration, salary, fee, commission, perquisites, any rent-free accommodation, or otherwise;

(iii). “arm’s length transaction” means a transaction between two related parties that is conducted as if they were unrelated, so that there is no conflict of interest.

Compliance provisions in regard to Related Party Transaction:

Exception to above:

In the case of Wholly Owned Subsidiary, the resolution passed by the holding company shall be sufficient for the purpose of entering into the transaction between the wholly owned subsidiary and the holding company.Some Important Notes:

If the transaction is in the ordinary course of business and done on an arm’s length basis it shall not require the approval of the board or the company.- No member shall vote on the special resolution if such member is a related party and this clause is not applicable to such Company in which ninety per cent. or more members, in number, are relatives of promoters or are related parties.

- Details of every contract entered into shall find its reference in the Board’s report along with justification about the same

- Ratification of the transaction may be done by the Board or the shareholders within three months. If the same is not done, then the contract will be voidable at the option of the Board.

- If the contract is with anyone related to the director, or is authorized by any other director, the directors concerned shall make good to the company for losses if any caused to the company.

For Directors or any other employee in default:

Listed Company

- Imprisonment – Maximum 1 Year months;

- Fine – Minimum Rs. 25,000/- and Maximum Rs. 5 Lakhs.

- Fine – Minimum Rs. 25,000/- and Maximum Rs. 5 Lakhs.

wonderful blog

ReplyDeletePioneer Cranes and Elevators is one of the TOP 5 Gantry Cranes Manufacturers. The offered product is exactly designed using the best grade raw material and latest technology in compliance with the set industry quality standards. Moreover, entire range of Goliath Cranes is tested on various parameters of quality in demand to deliver perfect product at clients' end.