Chartered account in delhi, tax consultancy in mumbai, tax consultant in india, foreign companies registration in india Visit us on https://neerajbhagat.com/

Tuesday, 23 June 2015

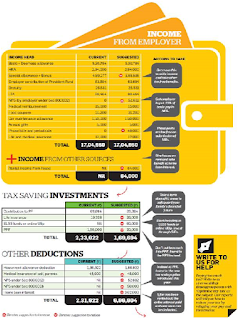

How to restructure your income, investments and expenses to optimise your tax

A Person, a 32-year-old manager in a Chartered account firm, is worried about his tax outgo. Lamba's company deducts more than Rs 10,000 as TDS every month from his salary. Lamba should rejig his salary structure. Instead of the high special allowance, his employer can put up to 10per cent of his basic salary in the NPS under Sec 80CCD2. He should also ask for perks such as newspaper and phone allowance which are tax free on submission of bills. These two measures will reduce his annual tax bill by Rs 20,000.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment