The Indian Accounting Standards (IND AS) are Accounting Standards, harmonized with IFRS (International Financial Reporting Standards)/IAS (International Accounting Standards) to make Financials Accounts and Reports of Indian Companies internationally accessible, acceptable, transparent and comparable.

Indian Companies have a far more global access as compared to earlier days and also because of leveraged policies of Indian Government toward the flow of FDI, a need was felt to introduce globally accepted Accounting Standards (IFRS). Most of the Countries in the world follow or adopt IFRS/IAS issued by International Accounting Standard Board (IASB). In India the Government has decided to converge and not to adopt IFRS. So, the converged IFRS named as IND AS has been notified by Government to implement it in phased manner by Indian Companies.

In this article we shall discuss the implementation of IND AS and its transitional impact on Indian Companies.

2. APPLICATIONS

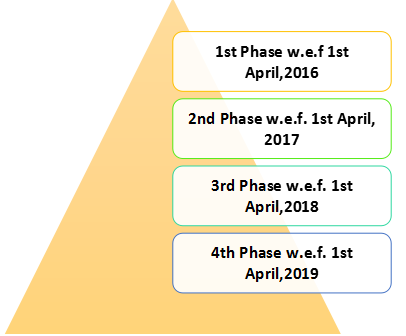

The Ministry of Corporate affairs (MCA) has notified the Companies (Indian Accounting Standards) Rules, 2015 for implementation of IND AS on Indian Companies in phased manner. Initially in 2015, the applicability of IND AS was on voluntary basis for the accounting period beginning on or after 1st April, 2015.

Mandatory Application

The Government has notified the mandatory application and preparation of financial statements of certain class of Indian companies, other than Banking Companies, Insurance Companies and NBFC’s, in the phased manner;

Notes:

a. Companies listed on SMEs Exchange are not required to apply IND AS.

b. Once IND AS becomes applicable it becomes applicable in all the subsequent financial statements even though it has been voluntary applied.

c. Net worth shall be checked for past three financial Year and it shall be calculated on standalone accounts of the company.

d. Companies not covered by the above roadmap shall continue to apply Accounting Standards notified in Companies (Accounting Standards) Rules, 2006.

a. IND AS will be applicable for both the consolidated and Individual Financial statements.

b. NBFCs having net worth below Rs. 250 crores shall not apply Ind AS.

c. Adoption of Ind AS is allowed only when required as per the roadmap. Voluntary adoption of Ind AS is not allowed

From the above, it seems that the Government of India is intentionally implementing IFRS converged Ind AS in the phased manner on Indian Corporates to bring the Financial Accounts and reports of the Indian corporates, its subsidiary, Associates and JV more transparent, comparable and globally acceptable. In so far as 39 Ind AS have been notified by the Ministry of Corporate Affairs in consultation with ICAI.

3. CHALLENGES AND OPPORTUNITY

There are a lot of challenges and opportunities in implementing Ind AS on Indian Corporates. There is a saying that “Challenges bring new opportunities” only the need is to understand the challenges and convert them into opportunities”.

The Challenges of implementing Ind AS before the Indian Corporates could be well understood and minimized by knowing the impact of implementing Ind AS.

| Challenges of Ind AS | Opportunity in Ind AS | |

| 1. | Shift from conventional cost method of Accounting to Fair Value Method of Accounting. | Fair Value Method of Accounting brings the transparency and true and fair presentation of financial transactions. |

| 2. | Changes in the various laws like The Companies Act, SEBI Regulations, Taxation Laws Banking and Insurance Laws/ Regulations etc. | Better Comparability and enhanced linkage to International trade and Business. It makes Cross Border acquisition and Joint Venture possible. |

| 3. | Lack of Expert and awareness about international practices. | New opportunities for Professionals and Business at large. |

| 4. | Change of Management Reporting System and Internal Control. | Reduction in reporting Cost, especially, in case of multinational companies. |

| 5. | Lack of awareness among users and stakeholders at Large. | New opportunities in service sector and professionals. |

4. IMPACT OF IMPLEMENTATION OF IND AS ON INDIAN COMPANIES:

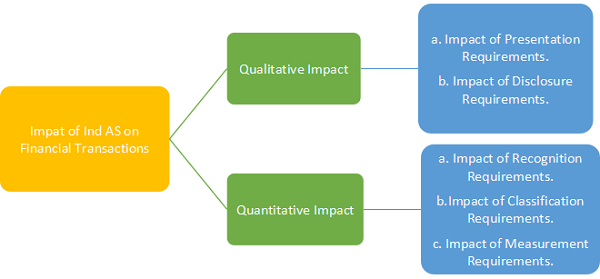

Implementation of Ind AS has changed the base and face of Financial Statements and Reports of Indian Corporates. It has changed not only the manner of presentation of Financials statements but also the principle of recognition and measurement of financial transactions and records. Therefore, we can say the conversion or transition to Ind AS is going to impact in both way qualitatively as well as quantitatively.

In this section we will discuss the impact of Ind AS on Indian Companies and their effect in comparing Indian Accounting Standards (IGAAP). Ind AS are different from existing Indian GAAP framework in three key aspects, i.e. measurement bases, substance over legal form and emphasis on the Balance sheet.

√ TRANSITIONAL PROVISIONS:

IND AS-101 (First Time adoption of Indian Accounting Standards)

New Format of Financial Statements:

The Ministry of Corporate affairs has inserted Division-II in schedule-III of the Companies Act, 2013 vide notification dated 6th April, 2016 which specifies minimum presentation and disclosure requirements in the financial statements of Companies complying with Ind AS.

Significant Requirement of Financial Statements complying with IND AS in comparison with financial statements prepared as per Accounting Standards (IGAAP).

| Requirement | Previous GAAP | INDIAS |

| Applicability | Companies not required to comply with IND AS shall prepare its financial statements as per the requirement of Part-I of the Schedule-III of the Companies Act, 2013. | Companies Preparing Financial Statements in compliance with the Companies (Indian Accounting Standard) Rules, 2015 shall prepare its financial statements as per the requirement of Part-II of the Schedule-III of the Companies Act, 2013. |

| Components of Financial Statements | > Balance Sheet> Statement of Profit & Loss

> Statement of Cash Flow

> Notes to Accounts, comprising a summary of significant accounting policies and other explanatory information.

| > Balance Sheet> Statement of Profit & Loss along with Statement of Comprehensive Income.

> Statement of Change in Equity (SOCE)

> Statement of Cash Flow

> Notes to Accounts, comprising a summary of significant accounting policies and other explanatory information.

|

| Statement of Comprehensive Income | In IGAAP , there is no concept of other Comprehensive Income but the concept of Exceptional items and Extraordinary Items. | In Ind AS and the applicable Schedule of Financials the concept of Exceptional items and Extraordinary items have been dispensed with and New concept of other Comprehensive Income have been introduced. This will include;a. Items that will not be reclassified to profit and Loss Account.

b. Items that will be reclassified to Profit and Loss Account.

|

| Statement of Change in Equity | In IGAAP and applicable standards and schedule, there is no concept of Statement of change in Equity. | In Ind AS and applicable schedule, there is requirement of preparing a Statement of Change in Equity by way of Note to the Balance Sheet. It does have two sections;a. Equity Share Capital;

b. Other Equity; It will be further sub classified for

i. Share Application Money Pending allotment.

ii. Equity Component of Compound Financial Instruments.

iii. Reserves and Surplus

iv. Items of Other Comprehensive Income

v. Money Received against share and warrants.

A Reconciliation of each item in the beginning and end of the period is to be disclosed.

|

| Consolidated Financial Statements | “Minority interests” in the Balance sheet within equity shall be presented separately from the equity of the owners of the parent. | Non-controlling interests’ in the Balance Sheet and in the Statement of Changes in Equity,within equity, shall be presented separately from the equity of the ‘owners of the parent’. |

| Property, Plant and Equipment’s | Classifications are as below:Tangible assets

Classification shall be given as:

(i) Land;

(ii) Buildings;

(iii) Plant and Equipment;

(iv) Furniture and Fixtures;

(v) Vehicles;

(vi) Office equipment;

(vii) Others (specify nature)

Intangible Assets included Goodwill.

| Classification shall be given as:(i) Land

(ii) Buildings

(iii) Plant and Equipment

(iv) Furniture and Fixtures

(v) Vehicles

(vi) Office equipment

(vii) Bearer Plants

(viii) Others (specify nature)

Goodwill is shown separately on the

face of the Balance Sheet and remaining shall be shown as Other.

|

| Investments Classification | Under each classification of investments details shall be given of names of bodies corporate indicating separately whether such bodies are> Subsidiaries

> Associates

> Joint ventures

> Controlled special purpose entities

The following shall also be disclosed.

(a) The basis of valuation of

individual investment

(b) Aggregate amount of quoted

investments and market value

thereof

(c) Aggregate amount of unquoted investments

(d) Aggregate provision made for

diminution in value of investments

| Under each classification ofinvestments details shall be given of names of bodies that are

> Subsidiaries

> Associates

> Joint ventures

> Structured entities

The following shall also be

disclosed.

(a) Aggregate amount of quoted

investments and market value

thereof

(b) Aggregate amount of unquoted

investments

(c) Aggregate amount of impairment in value of investments

Note: Under Classifications of Investments details, the term Structured entities has been used instead of controlled special purpose entities.

Investment are impaired rather than making Provision of diminishing in the value of Investment.

|

| Non-Current Loans and Advances | Long-term loans and advances shall be classified as:(a) Capital Advances;

(b) Security Deposits;

(c) Loans and advances to related parties (giving details thereof);

(d) Other loans and advances

| Loans shall be classified as-a) Security Deposits;

(b) Loans to related parties

(c) Other loans (specify nature).

Note: Capital Advances have to be separately disclosed under other non-current assets.

|

| Bank Deposits | Bank depositsBank deposits with more than 12-month maturity to be classified under Other bank balances | Bank depositsBank deposits with more than 12

months maturity to be classified

under Other Financial Assets.

|

| Investment Property | Investment property to be disclosed as part of Investment | Investment Property is disclosed as separate line item on the face of balance sheet.Also the following disclosure needs to be given

A reconciliation of the gross and net carrying amounts of each class of property at the beginning and end of the reporting period

showing additions, disposals, acquisitions through business combinations and other

adjustments. Therelated depreciation and impairment losses or reversals shall be disclosed separately.

|

| Trade Receivables | Trade ReceivablesAggregate amount of Trade receivable outstanding for a period exceeding six months from the date they are due for payment should be separately disclosed | Trade ReceivablesNo Such Requirements |

| Reserve and Surplus/Other Equity | Reserve and Surplus/Other Equity(i)Reserves and Surplus shall be

classified as:

(a) Capital Reserves;

(b) Capital Redemption Reserve;

(c) Securities Premium Reserve;

(d) Debenture Redemption Reserve;

(e) Revaluation Reserve;

(f) Share Options Outstanding Account;

(g) Other Reserves-(specify the nature and purpose of each reserve and the amount in respect thereof);

(h) Surplus i.e., balance in Statement of Profit and Loss disclosing allocations and appropriations such as dividend, bonus shares and transfer to/ from reserves, etc.;

| Reserve and Surplus/Other Equity(i) ‘Other Reserves’ shall be classified in the notes as-

(a)Capital Redemption Reserve;

(b) Debenture Redemption Reserve;

(c) Share Options Outstanding Account; and

(d) Others– (specify the nature and purpose of each reserve and the amount in respect thereof);

(Additions and deductions since last balance sheet to be shown under each of the specified heads)

Note: Retained Earnings represents surplus i.e. balance of the relevant column in the Statement of Changes in Equity(SOCE).

Instead of Reserve and Surplus term, the term other equity is to be used.

|

| Contingent Liabilities | Contingent liabilities Includes all Guarantees | Contingent liabilities pertaining to guarantees excluding financial guarantees. |

| Revenue | In respect of a company other than a finance company revenue from operations shall disclose separately in the notes revenue from-(a) Sale of products;

(b) Sale of services;

(c) Other operating revenues; Less:

(d) Excise duty

| Revenue from operations shalldisclose separately in the notes

(a) sale of products (including

Excise Duty);

(b) sale of services

(c) other operating revenues

|

| Dividend | Under IGAAP and applicable standards declaration of dividend is an adjustable event and related liability is to be recognized in the financials. | Under Ind AS The amount of dividends proposedto be distributed to equity and preference shareholders for the period and the related amount per share shall be disclosed separately.

Arrears of fixed cumulative dividends on irredeemable preference shares shall also be disclosed separately.

Note: It is to be disclosed by way of separate notes to the financials rather than to be recognized in the financial.

|

| Materiality | A Company shall disclose by way of notes additional information any item of expenditure and income which exceeds one per cent of the revenue from operations or Rs. 1,00,000 whichever is higher. | A Company shall disclose by way of notes additional information any item of expenditure and income which exceeds one per cent of the revenue from operations or Rs. 10,00,000 whichever is higher.Also disclosure is to be made of all material items i.e. the items if they could, individually or

collectively, influence the economic decisions that users make on the Financial Statements

|

Conclusively, it can be said that first attempt of preparation of Financial Statements complying with Ind AS requires expert knowledge of all notified Indian Accounting Standards, notified schedules, professional judgments and notes requiring disclosure thereof in first time preparation of Financial statements. It is the starting point of New era of Accounting and presentation and disclosure of financial transactions which requires a fair transition from historical cost method of accounting to the fair value of accounting.