Article explains Post Incorporation Compliances For Private Limited Companies which includes Compliances under Companies Act, 2013, Compliances under GST Law, Compliances under FEMA, RBI/FDI Reporting and Compliances with DGFT (Director General of Foreign Trade).

Part I: Compliances under Companies Act, 2013

♠ Hold first Board Meeting of the Company within 30 days from the date of Incorporation to discuss the agenda as written below in explanation I

♠ Opening of Bank Account within 60 days from the date of Incorporation

♠ Injection of Subscription money in the Bank Account of the Company within 60 days from the date of Incorporation

♠ Upon receipt of Subscription money, the Company shall issue share certificates in form SH-1 to the first subscribers within 60 days from the date of Incorporation

♠ Payment of Stamp Duty on Share Certificates within 30 days from the date of issue of share certificates

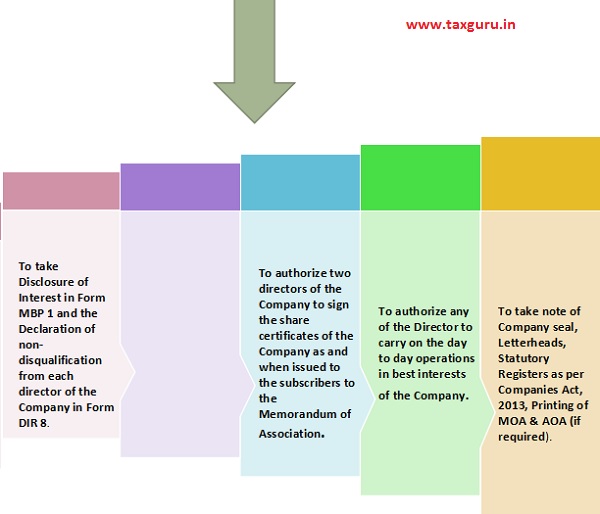

Within 30 days from the date of incorporation of the Company, the company shall hold first Board Meeting of the Company and the following agendas are required to be discussed:

Part II: Compliances under GST Act

GST registration

Company in India is required to register under GST Act i.e Goods & Service Act. The government will issue a GSTIN to be used for the future correspondences of the business of the company

Filing of returns

The Company is required to file the periodical (monthly & annually) returns as prescribed by the government on the prescribed due dates to provide detail regarding sale and purchase of goods & services and for claiming the input credit also.

Part III: Compliances under FEMA, RBI/FDI Reporting

Filling of Annual Return of Assets and Liabilities (“FLA Return”) by 15th day of July every year in respect of FDI on FLAIR portal of RBI and to file FLA Return, the Company should register itself on the FLAIR portal of RBI

Note: In case the subscribers to the memorandum of association of the Company are foreign nationals or the funds have been received by the Company from the country other than India, then the FDI Reporting under FEMA Regulations, 1999 has to be complied with.

Part IV: Compliances with DGFT (Director General of Foreign Trade)

Application to obtain Import Export Code (“IEC”)

Govt. Fees for application for registration is Rs. 500/-.

Application for modification in IEC

The Company is required to intimate about the changes in the details given initially at time of applying IEC to the department for modification in the IEC.

Hiii..I really appriciate you for posting this kind of blog. Visit our website for Private Limited Company Compliances

ReplyDeleteGood and much useful article.

ReplyDeletePost incorporation compliance of section 8 companies