The Construction/ Real Estate sector is one of the most critical sectors of the Indian economy due to its huge multiplier effect on the economy. Any impact on the Real Estate sector has a direct bearing on economic growth. Due to the well-acknowledged need for foreign investments into this sector because of the sheer demand, the Foreign Direct Investment (FDI) route has attracted foreign investors’ interest in this sector.

In the year 2005, Reserve Bank of India (RBI) issued a notification and the township, housing, construction development project sector and built up infrastructure was opened for 100% FDI with specific terms and conditions.

The Reserve Bank of India has recently relaxed norms on end-use of funds raised via external commercial borrowings, making it more attractive and viable for corporates including non-banking finance companies to raise cheaper offshore funds. With a view to further liberalize the ECB framework, it has been decided to relax the end-use restrictions and allow the use of funds for working capital requirements, general corporate purposes and repayment of rupee loans. ECBs with a minimum average maturity period of 10 years can now be used for working capital purposes and general corporate purposes.

These changes will improve ease of doing business in India.

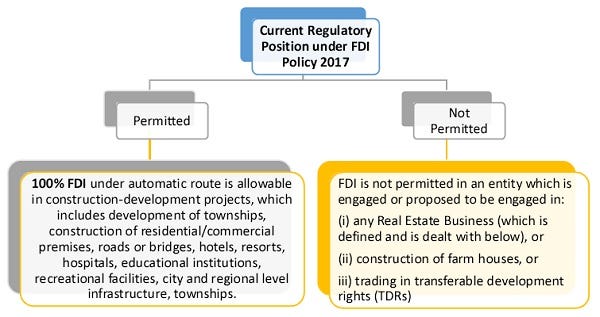

There have been changes in FDI policy in this sector from time to time and following is the updated policy as of now.

*Real Estate Business

“Real Estate Business” has been defined as dealing in land and immovable property with a view of earning profit there from and does not include development of townships, construction of residential/commercial premises, roads or bridges, educational institutions, recreational facilities, city/regional level infrastructure, townships. Significantly, the earning of rent or income, not amounting to transfer, from lease of a project in which FDI is permitted would not tantamount to ‘Real Estate Business’.

“Real Estate Business” has been defined as dealing in land and immovable property with a view of earning profit there from and does not include development of townships, construction of residential/commercial premises, roads or bridges, educational institutions, recreational facilities, city/regional level infrastructure, townships. Significantly, the earning of rent or income, not amounting to transfer, from lease of a project in which FDI is permitted would not tantamount to ‘Real Estate Business’.

Applicable conditions for FDI in Real Estate Sector in India:

ConditionsApplicability under FDI Policy 2017Minimum CapitalizationNo minimum requirementExit and Lock-in restrictions• The investor is permitted to exit from the investment: (i) after 3 years from the date of each tranche of foreign investment, or (ii) on the completion of the project; or (iii) on the completion/development of trunk infrastructure i.e., roads, water supply, street lighting, drainage and sewerage.• The lock-in period of 3 years will also not apply to Hotels & Tourist Resorts, Hospitals, Special Economic Zones, Educational Institutions, Old Age Homes and investment by NRIs.Transfer of stake from a non-resident investor to another non-resident investorTransfer without any repatriation of investment is not subject to any lock-in or prior RBI approval.Separate Phases/ProjectsEach phase of a project is considered as a separate project for the purposes of the FDI PolicyMinimum Land StipulationThere is no minimum area requirement.Completed Assets• 100% FDI is permitted under automatic route into completed projects for operation and management of townships, malls/ shopping complexes and business centers.• However, there is a lock-in period of 3 years applicable.Transfer of control from residents to non-residentsTransfer of control from residents to non-residents as a consequence of foreign investment is also permitted. However, there is a lock in period of 3 years applicable and no transfer of immovable property is permitted during this period.Earning or rent/income on lease of the propertyFDI is not permitted in an entity which is engaged or proposes to engage in ‘Real Estate Business’. However the earning of rent/ income on lease of the property, not amounting to transfer, does not amount to ‘Real Estate Business’ and hence is permitted.Obligations on Indian Investee company• Indian Investee Company is permitted to sell only developed plots, i.e. the plots where trunk infrastructure has been available.• Indian Investee Company is responsible for obtaining all approvals, payment of development and other charges, and compliance with all other requirements as prescribed by local government bodies.Authority to monitor complianceThe State Government/Municipal/Local Body concerned, which approves the building/development plans, will monitor compliance of all the conditions by the developer.

Open Conditions

- Timeline at which stage the foreign investment must come in is not provided in the existing regulations and the clarification on the same is awaited.

- In the absence of any timeline for investment, since the FDI is permitted in construction-development projects, it is to be seen at what stage a project can qualify as being in the ‘construction-development’ phase.

- Real estate being a state subject, any guidelines or regulations by state for the benefit of foreign investors would be a welcome step and is awaited.

Take Away

RBI has been regularly improving the real estate sector for FDI, which will hold great potential for formation of employment and generation of income. Furthermore, considering the urgent need to enhance the affordable housing stock, the government had provided definite relaxations to conditions for FDI in Real Estate sector. It also clarified that real estate broking services do not amount to real estate business and are, therefore, eligible for 100 per cent FDI under the automatic route.

RBI has been regularly improving the real estate sector for FDI, which will hold great potential for formation of employment and generation of income. Furthermore, considering the urgent need to enhance the affordable housing stock, the government had provided definite relaxations to conditions for FDI in Real Estate sector. It also clarified that real estate broking services do not amount to real estate business and are, therefore, eligible for 100 per cent FDI under the automatic route.